Last updated: 01 December 2025

FSCS protection for business accounts: at a glance

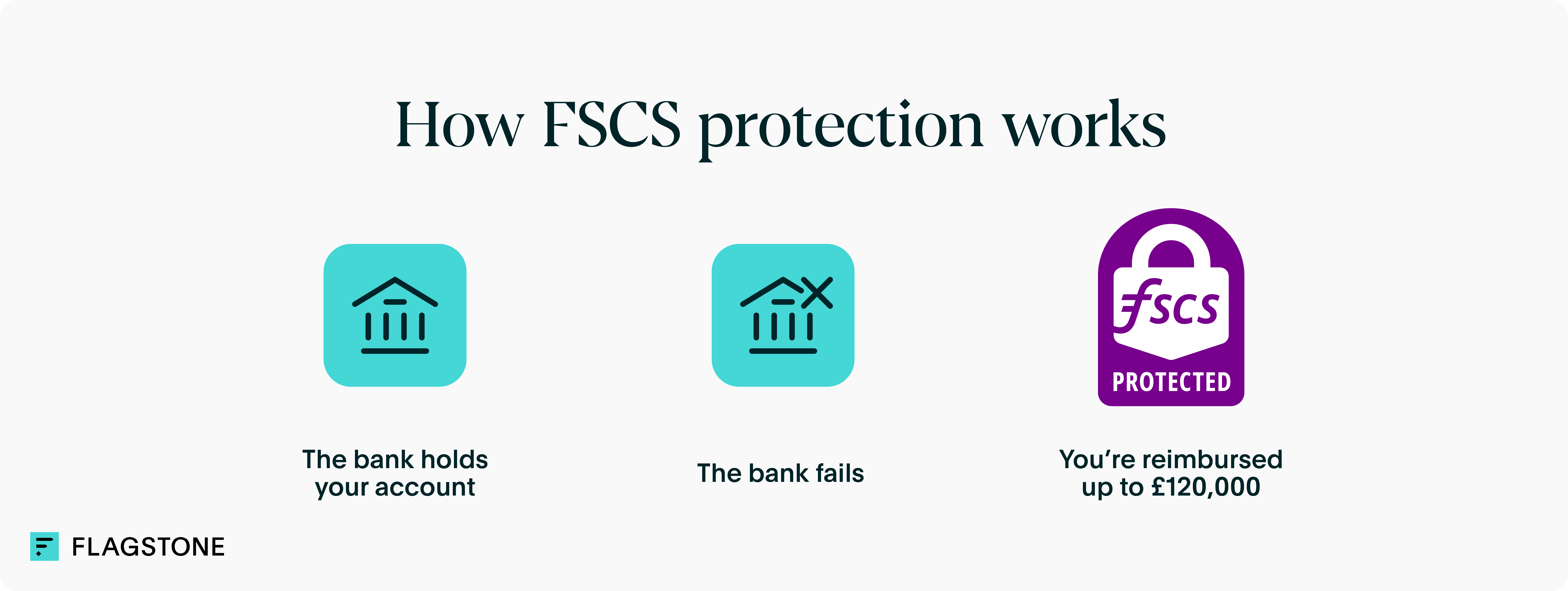

- What do I need to know? Your company’s cash reserves are likely only protected up to £120,000. But you can expand your coverage by opening multiple savings accounts with different banks.

- Why does it matter? Even if you spread money across two different accounts, they could still operate under the same license. This limits reimbursements if your bank goes out of business.

- What does it mean for me? CFOs can increase their protection and expand their returns with high-interest savings platforms like Flagstone.

Initially launched in 2001, the UK’s Financial Services Compensation Scheme (FSCS) has evolved significantly over the years.

Although the protection is regularly cited as one of the primary reasons that consumers can save their cash with low risk, businesses are often unsure how the scheme applies to them.

In this article, you’ll learn why businesses often have less protection than they might expect. You’ll also discover how you can secure and manage more of your cash with powerful, easy-to-use tools.

What is the FSCS?

The FSCS is the UK’s compensation scheme that protects customers of regulated financial services firms. It was set up by the UK government in 2001 to cover bank deposits.

If an authorised financial services provider goes out of business and is unable to repay customers’ deposits, the FSCS will provide compensation up to a certain limit. The limits apply per person, per financial institution. Different rules apply if there are multiple account holders listed (more on that later).

This means if you’ve divided your company’s cash between two separate financial institutions, you can significantly increase your level of protection.

How does FSCS protection for business accounts work?

FSCS protection for business accounts has varied over the years.

Previous limitations on FSCS protection for businesses

Before 2015, there were restrictions in place to limit FSCS protection for business accounts over a certain size. Companies had to employ fewer than 250 staff, have a turnover of no more than £44m, and a balance sheet of no more than £39m to qualify.

These restrictions no longer apply.

How much of your cash is protected by the FSCS?

Currently, if you’re an individual, cash deposits are protected by the FSCS up to the value of £120,000 with an authorised bank or building society. Protection applies per person, per financial institution, with joint accounts qualifying for £240,000 reimbursements.

Business accounts are also typically covered up to £120,000 in total, but it can depend on the structure of your business. For example, partnerships are treated as a single entity, so you don’t get the same protection as you may enjoy with a personal joint account.

Multiple accounts don’t guarantee FSCS protection for businesses

Banks and building societies can sometimes share banking licenses. This can happen when institutions are part of the same banking group. In these circumstances, the FSCS treats the group as one bank. This is why you only have £120,000 of protection, even with two accounts or more.

It’s important for CFOs and Finance Directors to ensure that their different accounts are independent in terms of licensing.

With Flagstone, you can quickly see how much FSCS protection your deposits enjoy.

How does this work in practise?

Naomi runs a small design agency. After a strong year, she decides to divide her cash reserves between accounts held with two separate banks. Bank A and Bank B.

The problem

Unbeknownst to Naomi, bank A and bank B share a banking licence.

She deposits £100,000 in Bank A, and £100,000 with Bank B. Due to an unexpected financial crisis, both banks go out of business. Naomi only receives £120,000 in compensation.

This means her business has endured a £80,000 loss.

The solution

Naomi joins Flagstone, which informs her that her cash is only protected up to £120,000.

She moves £100,000 to Bank C, which has its own license.

When the financial crisis hits, Naomi is reimbursed the full amount.

She loses none of her £200,000 in cash reserves.

Not all financial institutions are covered

The FSCS doesn’t cover e-money institution (EMI) or payment services firms. Although these businesses provide financial services regulated by the FCA, they operate without a full UK banking licence.

But every bank and building society that’s authorised and regulated by the Prudential Regulation Authority (PRA) is covered by the FSCS.

All accounts listed on Flagstone’s savings platform are FSCS protected.

How to maximise protection of your company’s cash reserves

For time-poor CFOs and Finance Directors, managing multiple accounts can be complex. Additionally, it may be unclear whether financial entities are legally distinct from one another.

But maximising FSCS cover depends on finding sensible ways to diversify cash reserves across multiple bank accounts with unique licenses.

Savings platforms like Flagstone make it straightforward to open, manage, and fund multiple accounts for your business’s cash. You can combine different types of accounts, locking in high interest at fixed rates, while keeping additional cash reserves in instant access accounts in case of emergency.

The platform is designed to show you how much of your money is eligible for FSCS protection. Our share of interest funding model means you always know how much interest you’re getting paid.

No hidden fees, or costs.

Frequently asked questions about FSCS business accounts

Are business accounts covered by FSCS?

Yes, you’re protected by the FSCS provided your bank or building society account is authorised and regulated by the PRA.

All accounts listed on Flagstone’s savings platform qualify for FSCS protection.

There used to be limits on whether you could get FSCS protection based on the size of your business. But those restrictions no longer apply.

Is it safe to have more than £120,000 in the bank in the UK?

Although savings are considered one of the lowest risk assets you own, there is always a chance that the bank you hold your account with could go out of business.

This is why people and businesses with money over the £120,000 protection limit often open multiple savings accounts with a handful of banks.

Is my business bank account protected?

You’ll need to check whether your account is authorised and regulated by the PRA. If you only have one business bank account, it’s likely the FSCS protects just £120,000 of your cash reserves.

You can increase your protection by opening multiple savings accounts for your business.

Savings platforms like Flagstone let you manage this in one place.

Is my money safe in a business account?

Depending on how your financial provider is regulated, your business account may be protected for up to £120,000.

Instances like the collapse of Silicon Valley bank in 2023 demonstrate that although savings are considered low risk, they are never entirely risk-free.

This has led CFOs and Finance Directors to consider placing deposits across multiple accounts, to shore up company cash reserves ahead of unpredictable events.

Savings platforms like Flagstone make this process easy, streamlining cash management across regulated institutions in one place.

Greater FSCS protection for business accounts is possible

Your company’s cash reserves are essential to the health of the business. But there is a chance your cash may not be protected if it’s held in an e-money account.

By opening multiple savings account for your business, and managing them in one place, finance experts can safeguard cash reserves and earn significant interest at the same time.

Open, manage, and optimise your business savings accounts with Flagstone

With a single application, you can access hundreds of accounts with 40+ banks – more than any other savings platform.

All in one place, with one login.