Monthly interest accounts: at a glance

- What do I need to know? Monthly interest savings accounts pay interest each month, rather than annually.

- What does it mean for me? You can choose to leave your cash to compound, increasing future returns, or withdraw monthly for a passive income.

- Why does it matter? While monthly interest payments provide a predictable, regular income stream, you might be losing out on more competitive rates if you choose to withdraw.

Monthly interest savings accounts provide flexibility in how you manage your earnings. Depending on your priorities, you can either secure a steady income from the interest or reinvest it to grow your cash over time.

In this guide, you’ll learn how to calculate monthly interest and determine whether a monthly interest savings account aligns with your financial goals.

What is a monthly interest savings account?

A monthly interest savings account pays your interest every month, instead of annually.

The payment date is typically set by the account provider, either on a fixed day or on the anniversary of the account opening.

How do monthly savings accounts work?

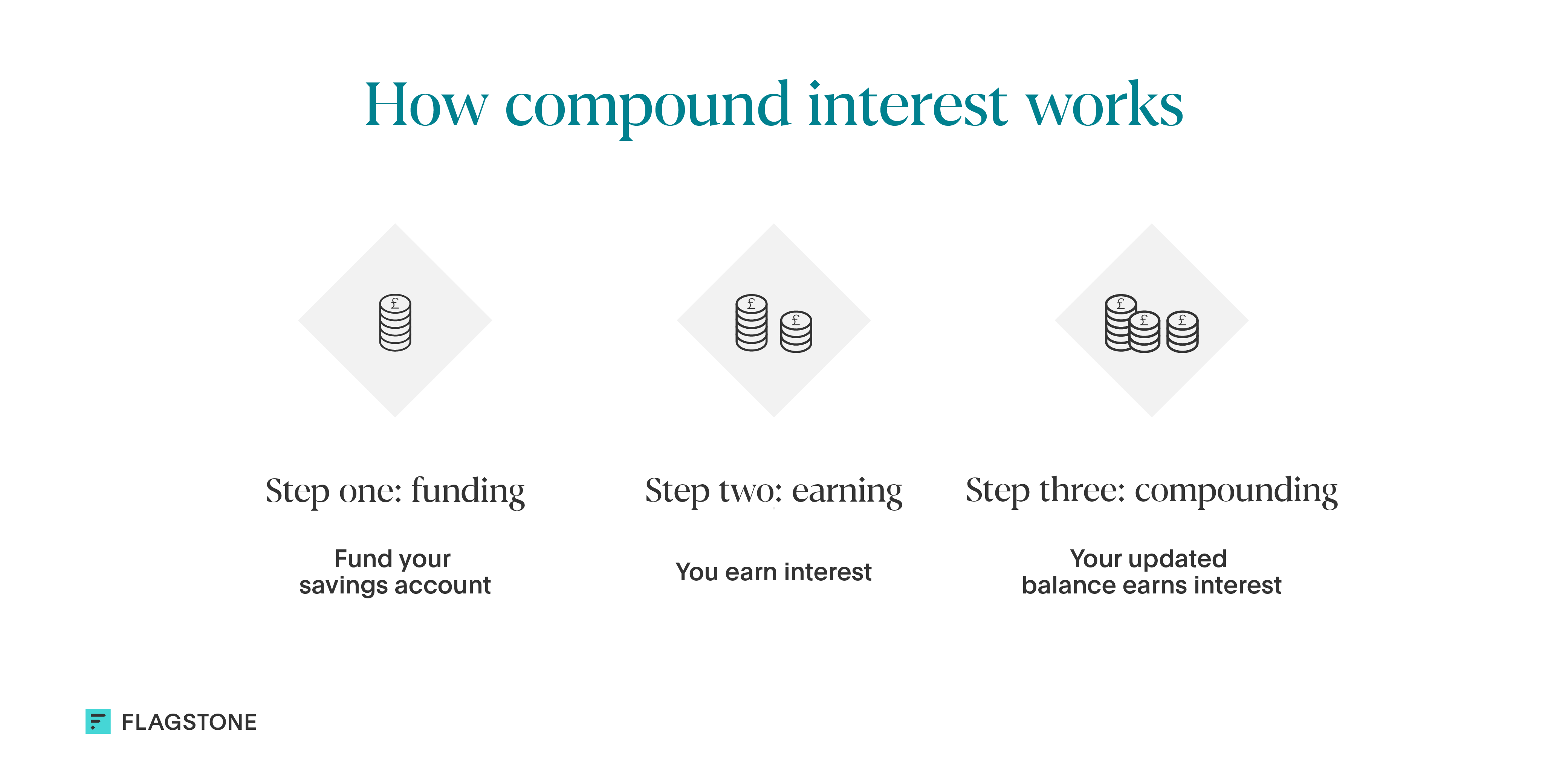

Each month, you earn interest on your deposit.

Your bank automatically pays this into your account, letting you supercharge your savings through compound interest if you don’t withdraw funds.

How to calculate your monthly interest

Most savings accounts will show your interest rate as an AER (Annual Equivalent Rate), which reflects your expected yearly return after factoring in compound interest.

Monthly interest is calculated as a twelfth of your annual interest.

To work out how much interest you’ll earn in a monthly savings account, start by working out your monthly interest rate and add it to your account balance.

To work out the next month’s interest, simply do the same with your new total. You can repeat this process to work out how much you could earn over a set period, like a year.

Example: calculating your monthly earnings on £100,000

To calculate your monthly interest on a £100,000 deposit in an account offering 4% AER, follow these steps:

Work out your monthly interest rate: 0.04 ÷ 12 = 0.00333%

Calculate your monthly earnings: 100,000 x 0.003 = 333.33

Add your monthly earnings to your total: £100,333.33

Repeat, starting with your new total.

Monthly vs. annual interest accounts: which is better?

The difference between monthly and annual interest accounts is compounding frequency.

Monthly interest savings accounts pay interest more regularly. Because of compound interest, this means the interest you earn increases at a faster rate.

Monthly interest accounts also give you more regular payouts if you plan to withdraw your interest. But you’ll lose the momentum you can build through compound interest.

Monthly interest accounts often have slightly lower interest rates due to the regular payouts and flexibility they deliver.

By contrast, annual accounts typically offer higher rates, especially for fixed-rate accounts, where your funds are locked away for longer.

What are the different types of monthly interest savings accounts?

There are different types of monthly interest savings accounts:

| Instant access accounts | You can withdraw your cash or interest at any time. In exchange for this flexibility, you usually get a lower interest rate. |

| Fixed-rate accounts | These accounts can offer more competitive rates, but you won’t be able to withdraw interest monthly. Your cash compounds until the term you agree to ends. |

| Notice accounts | These accounts can offer competitive monthly interest rates, but you’ll need to give advance notice to withdraw funds (usually around 30-90 days). |

| Individual Savings Accounts (ISAs) | Some ISAs pay interest monthly. Interest earned on ISA deposits is tax-free within your £20,000 annual allowance. |

Why should I open multiple monthly savings accounts?

By spreading your savings across multiple accounts, you can get full Financial Services Compensation Scheme (FSCS) protection, safeguarding your cash if your bank goes out of business.

You can also take advantage of different account features, combining the higher interest rates of a fixed-term account with the flexibility of an instant access savings account.

Frequently asked questions about monthly savings accounts

Is a monthly interest savings account a good idea?

Monthly interest savings accounts can grow your wealth through compound interest, or give you regular access to interest payments.

This makes them a popular addition to a balanced savings portfolio.

How do you calculate 5% interest monthly?

To work out how much monthly interest you’ll earn in a savings account, divide the annual interest rate by 12.

For example, if the annual interest rate is 5%, you would divide 5% by 12, giving you a monthly rate of approximately 0.4167%. This rate is then applied to your account balance each month.

How much monthly interest will I earn on £1m?

Your monthly earnings depend on the interest rate you secure.

For example, here’s how much monthly interest you could earn on £1m*, with a 4% annual interest rate:

| Month | Interest earned | Account balance |

| Deposit | £0 | £1,000,000 |

| 1 | £3,333.33 | £1,003,333.33 |

| 2 | £3,344.44 | £1,006,677.77 |

| 3 | £3,355.59 | £1,010,033.37 |

| 4 | £3,366.77 | £1,013,400.14 |

| 5 | £3,378 | £1,016,778.14 |

| 6 | £3,389.26 | £1,020,167.40 |

*This example is for illustrative purposes only and is not to be used as an accurate prediction of your earnings. The exact amount of interest may be higher or lower as it depends on the account you open, the rate of interest, and your personal circumstances among other factors.

Grow your cash with monthly savings accounts

Combining different types of accounts gives you greater control and flexibility to meet your financial goals.

Monthly savings accounts can support a diversified financial plan by allowing you to either grow your balance through compound interest, or withdraw funds each month as a passive income.

Deciding whether monthly or annual savings accounts are best for you depends on your priorities.

Combine multiple monthly savings accounts with Flagstone

Grow your cash with access to multiple savings accounts from 65+ banks, with Flagstone.

All in one place, with one login.