Savers urged to ‘wake up their savings’ as Bank of England holds rates

The Bank of England has held the base rate at 4.5% – but cuts could be coming. Now’s the time to ask yourself: is your cash reaching its full potential? Discover how to secure better returns today.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

Today, the Bank of England’s Monetary Policy Committee (MPC) voted to hold the base rate at 4.5% for a second consecutive month.

But not all were in favour. The MPC voted by a majority of 8-1.

One member, Swati Dhingra, advocated to cut the base rate by 25 basis points, saying that ‘disaggregated data pointed to inflation continuing to decline through both wage and price-setting channels.’

Governor Andrew Bailey said the Bank of England will continue its ‘gradual and careful approach’ to cutting rates.

Commenting on today’s outcome, Bailey said:

‘There’s a lot of economic uncertainty. We still think that interest rates are on a gradually declining path. We’ll be looking very closely at how the global and domestic economies are evolving.’

What spurred the MPC’s decision?

One of the key factors contributing to today’s cautious approach is the slowing economy. The latest data from the Office for National Statistics (ONS) shows that GDP unexpectedly dropped by 0.1% in January.

GDP measures the value of goods and services produced in a country over a period of time. It serves as an indicator of the size, growth, and health of the economy.

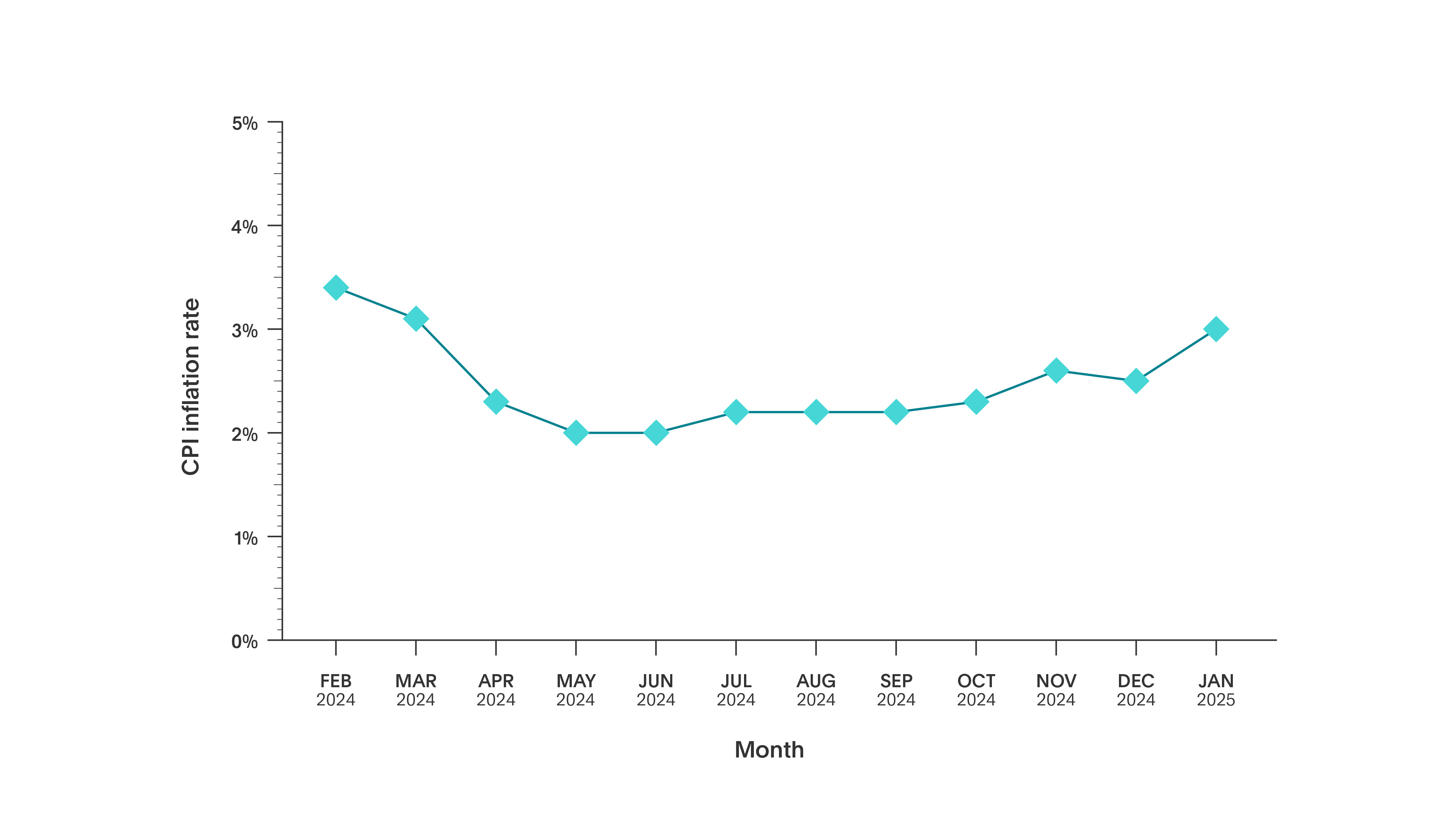

Above target inflation also adds pressure to the Bank to keep rates steady. In January 2025, inflation – the rate at which prices rise – rose to 3%, up from 2.5% in December 2024.

Inflation is forecast to rise to 3.7% this year and take until the end of 2027 to fall back to its 2% target.

Are interest rates going down?

The MPC has been gradually cutting the base rate since August last year. Economists predict the next drop to be May, followed by further reductions in August and November.

Time to wake up your savings

The gap between inflation and interest rates on savings accounts is shrinking.

Now’s the time to ask yourself: could you be earning more from your money?

With rates holding steady for another six weeks, it’s worth reviewing your current savings strategy before future cuts.

‘Millions of savers could be earning double what they are today. The first step is staying informed – knowing your interest rate and knowing where to look for better options.’

Loyalty to old accounts often doesn’t pay off, as many don’t offer competitive rates. If you want to put your money to work, consider switching to accounts that provide higher interest.

There’s still a variety of strong rates on offer for both short and long-term accounts. If you’re able to lock your cash away for longer, Fixed Term accounts usually offer higher returns.

Don’t let your cash get too comfortable

For many savers, switching accounts can feel risky, complicated, or just too much hassle. Sound familiar? If so, you’re not alone.

The latest data shows that £1.3tn in UK savings is asleep in low-interest accounts. When cash is left to languish, it’s savers like you who pay the price.

Put a spring in your savings – with Flagstone

If switching feels overwhelming, savings platforms like Flagstone simplify the process. You’ll benefit from access to hundreds of competitive accounts from over 60 banks – all with one login.

Use our interest rate calculator to discover how much more your money could be earning.

What happens next?

The next base rate announcement is Thursday 8 May at 12.00pm. The MPC will need to wait until then to discuss any measures Finance Minister Rachel Reeves announces in the Spring Statement on Wednesday 26 March.

Stay up-to-date on all things savings

For all the latest updates, as they happen, follow us on LinkedIn.